Why U.S. Founders Are Looking at Serbia: How to Open your Company in Serbia

Introduction

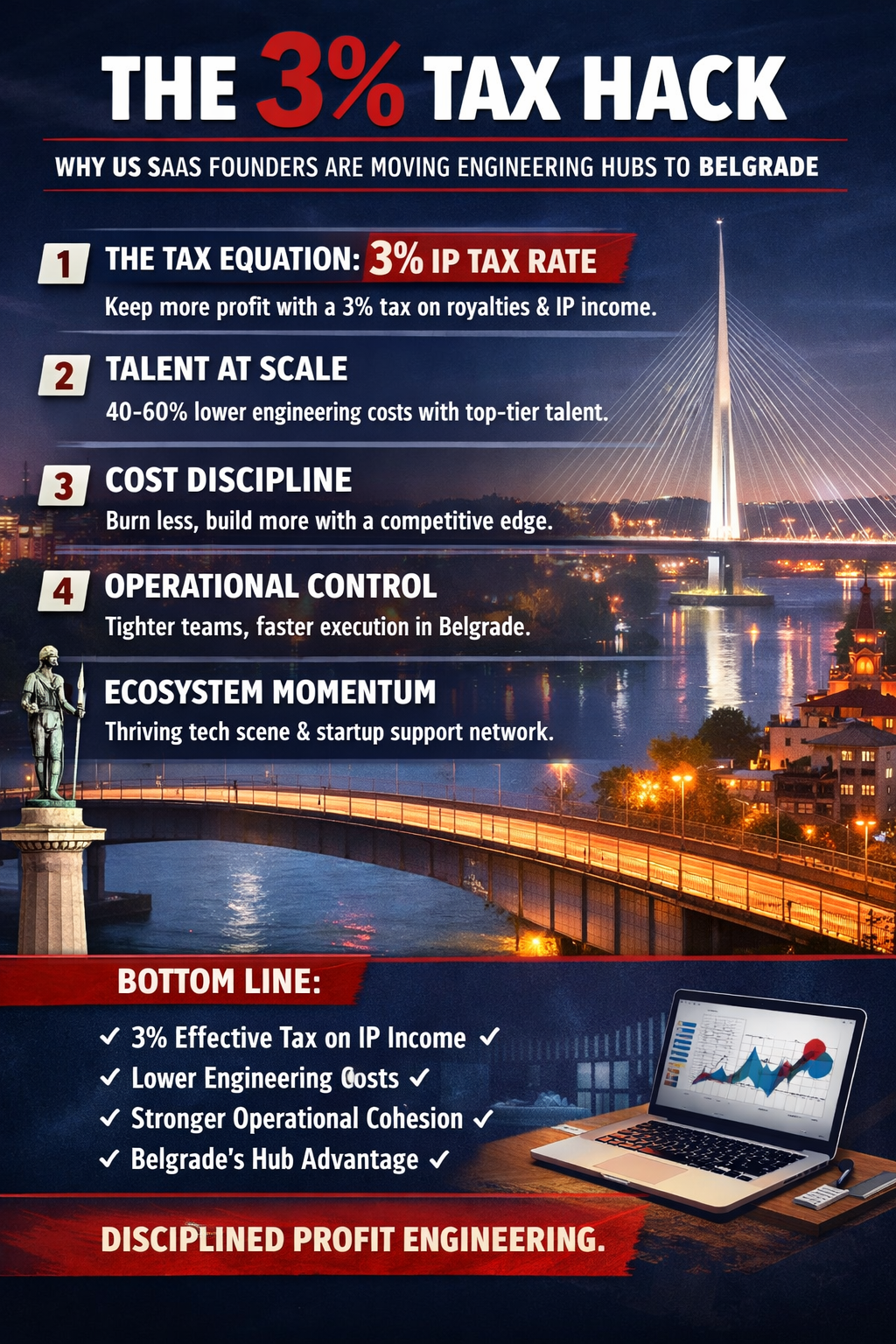

While Trump’s second-term policies have reignited uncertainty in the U.S., many American founders are looking abroad for stability, lower costs, and fast-track residency options. Serbia has quietly become a leading destination, offering one of the cheapest incorporation processes in Europe and a strategic position between the EU and global markets.

Step 1: Company Formation with APR

Registration begins at the Serbian Business Registers Agency (APR). The minimum founding capital is 100 dinars (around 1 euro), one of the lowest in Europe. https://www.apr.gov.rs

Founders must submit notarized incorporation documents, including the founding act, proof of registered office, and shareholder details.

https://www.apr.gov.rs/registri/privredna-drustva/obrasci-i-uputstva

Step 2: Obtaining a PIB from the Tax Administration

After APR registration, the Serbian Tax Administration issues a PIB (tax identification number). Without it, a company cannot issue invoices, hire staff, or open a bank account. https://www.purs.gov.rs

Step 3: Bank Account Setup

Corporate bank accounts are opened under the supervision of the National Bank of Serbia (NBS). Banks require a complete KYC pack including APR extract, PIB, ID documents, and a source-of-funds declaration. https://nbs.rs

Step 4: Payroll and Compliance

Before hiring, every employer must register with the Central Registry of Compulsory Social Insurance (CROSO). https://www.croso.gov.rs

As of 2025, employee social contributions are 19.9% and employer contributions are 15.15% of gross salary. Salary tax is 10% after allowances. These rates are published by the Tax Administration and the Ministry of Finance. https://www.purs.gov.rs

Why Serbia Over EU Hubs?

Serbia’s 15% corporate tax undercuts Germany’s 30% and Poland’s 19%. Combined with low labor costs and startup-friendly laws, it’s a strong alternative. https://taxsummaries.pwc.com/serbia/corporate/taxes-on-corporate-income

Sifted reported that U.S. tech workers are weighing relocation to Europe after Trump’s win, and Serbia offers a straightforward path for these founders. https://sifted.eu/articles/us-tech-workers-move-to-europe-post-trump

Conclusion

Opening a company in Serbia is fast, cheap, and gives founders a legal base in Europe with residency options. For U.S. entrepreneurs navigating uncertainty at home, Belgrade is no longer a hidden secret — it’s the next move.